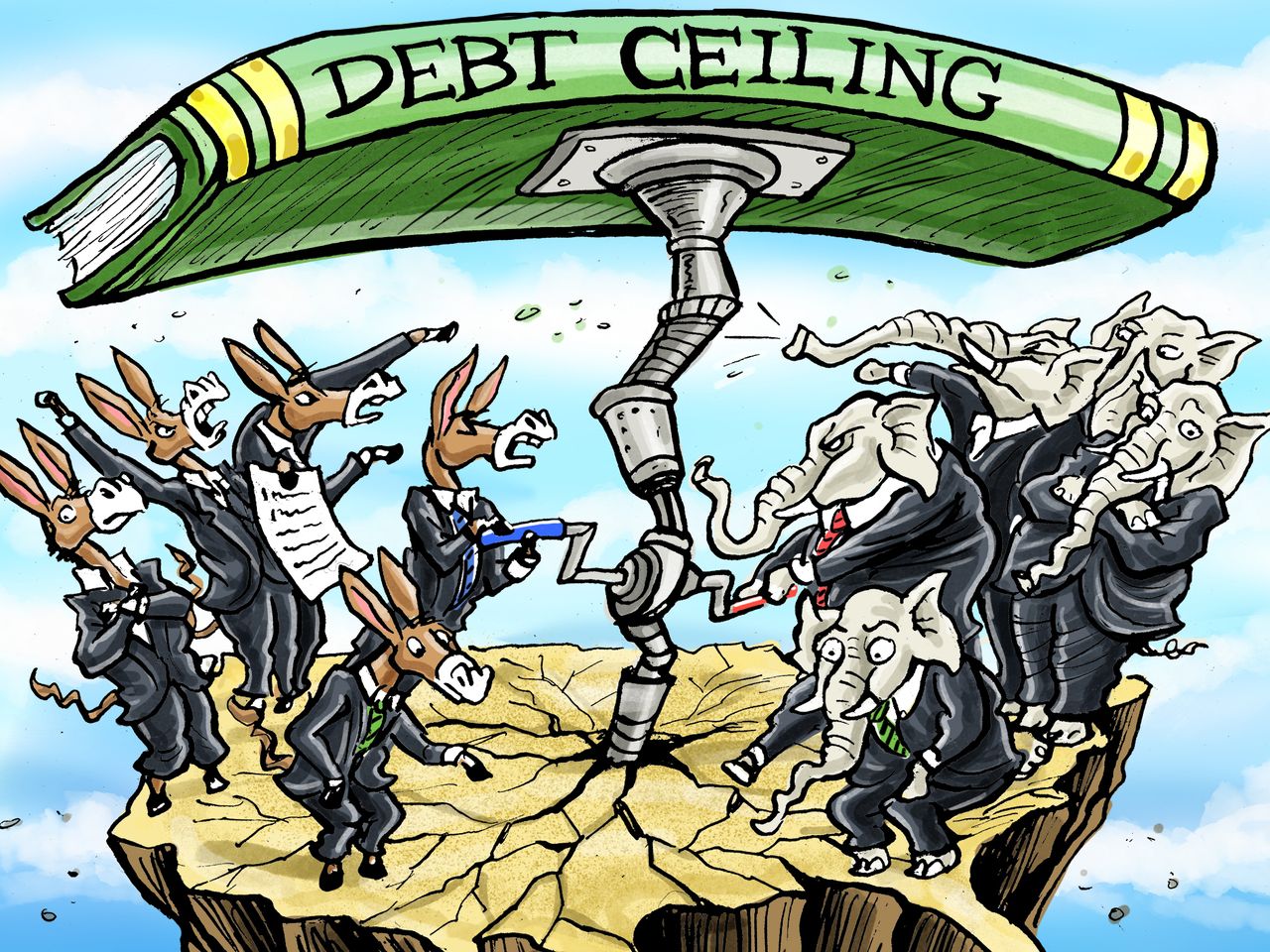

(BBR) The debt ceiling is an integral component of fiscal policy, serving as a statutory limit on the amount of debt the government can incur. However, this seemingly routine legislative measure carries profound economic implications. From financial market volatility to potential disruptions in government operations, the debt ceiling has far-reaching consequences that demand careful consideration. This article aims to explore the economic perspective surrounding the debt ceiling and shed light on its complexities.

The Impact of Uncertainty:

One of the immediate effects of the debt ceiling debate is the introduction of uncertainty into financial markets. When the government approaches its borrowing limit, concerns arise regarding its ability to meet its obligations. Investors demand higher yields to compensate for the increased risk, resulting in higher borrowing costs for the government. The ensuing market volatility can have ripple effects on business and consumer confidence, potentially hindering investment and consumption, and impeding overall economic growth.

Fiscal Policy Limitations:

The debt ceiling can also constrain the government's capacity to implement fiscal policies effectively. During economic downturns, governments often employ expansionary fiscal measures to stimulate the economy. These may include increased government spending or tax cuts to encourage investment and consumer spending. However, a binding debt ceiling restricts the government's ability to enact such policies, rendering them less potent in combating economic hardships. This limitation calls for a delicate balance between managing debt and pursuing economic recovery.

Government Debt and Long-Term Fiscal Sustainability:

The debt ceiling is intricately linked to the broader issue of government debt. A high level of debt poses risks to economic stability and growth. As government debt increases, it can crowd out private investment by absorbing available capital, driving up interest rates for businesses and consumers. This crowding-out effect can stifle economic activity and hamper long-term growth prospects. Furthermore, a substantial debt burden erodes confidence in the economy and raises concerns about the government's fiscal sustainability, potentially leading to higher borrowing costs and further economic strain.

Avoiding Default and Financial Fallout:

Perhaps the most severe consequence of breaching the debt ceiling is the risk of default on financial obligations. A failure to raise the debt ceiling in a timely manner could lead to a government shutdown or an inability to pay interest on existing debt. The consequences of defaulting on debt payments would be catastrophic, including disruptions in financial markets, a loss of investor confidence, and a potential downgrade in the country's credit rating. Such outcomes can trigger a severe economic downturn and have lasting repercussions for years to come.

Conclusion:

The debt ceiling, while often seen as a routine legislative procedure, holds immense economic significance. Its impact on financial markets, the constraints it places on fiscal policy, and its implications for government debt and long-term fiscal sustainability cannot be underestimated. Balancing the need for responsible debt management with the pursuit of economic growth and stability is a formidable challenge. Policymakers must navigate this delicate balancing act with prudence and foresight to ensure the economic well-being of the nation.

By understanding the economic ramifications of the debt ceiling, we can foster informed discussions and decisions surrounding this crucial aspect of fiscal policy. Only by approaching this complex issue with a comprehensive understanding of its implications can we strive to achieve a stable and prosperous economic future.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or legal advice. Please consult with a professional advisor or relevant authority for specific guidance on the debt ceiling and its implications

The Debt Ceiling and Its Economic Ramifications: A Delicate Balancing Act

Typography

- Smaller Small Medium Big Bigger

- Default Helvetica Segoe Georgia Times

- Reading Mode